Owning a classic Japanese car is a passion that extends beyond just driving; it is about preserving a piece of automotive history. With the rising value of these vehicles, appropriate insurance coverage becomes essential to protect your investment. Understanding the unique needs of classic cars can help you navigate the complex world of insurance policies designed specifically for vintage automobiles.

When it comes to insuring classic Japanese cars, standard auto insurance may not provide the necessary coverage. Classic cars often appreciate in value, which means it’s vital to work with an insurance provider that understands the intricacies of valuation and potential restoration costs. Specialty insurance companies offer policies that take into account the unique aspects of classic vehicles, providing tailored coverage that can include agreed value and limited mileage options.

Moreover, classic Japanese cars often have different usage patterns compared to regular vehicles. Many owners utilize their cars for shows, club events, or casual weekend drives rather than daily commuting. This lifestyle impacts the type of insurance necessary to ensure complete protection. By opting for a policy that reflects your vehicle’s specific usage, you can often save on premiums while still securing comprehensive insurance coverage.

Evaluating Coverage Options for Vintage Models

When it comes to protecting your classic Japanese car, understanding the right coverage options is crucial. Vintage models often require specialized insurance due to their unique characteristics and potential value appreciation over time.

Firstly, it’s essential to consider agreed value coverage. This type of policy ensures that you and your insurer agree on the car’s value before any damage occurs. In case of a total loss, you’ll receive the agreed amount, providing peace of mind and financial protection.

Another important option is liability coverage, which protects you in the event of causing damage to another vehicle or injury to another driver while operating your classic car. State requirements vary, so understanding minimum coverage needs is vital. However, opting for a higher limit could provide better protection and minimize personal financial risk.

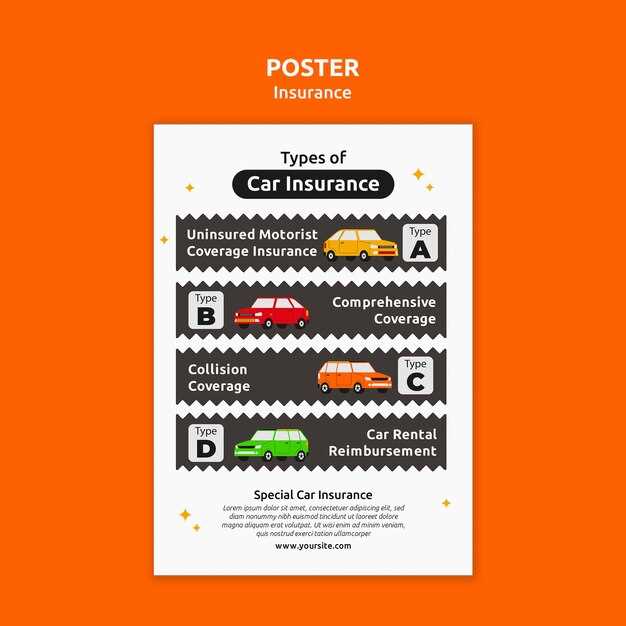

Additionally, consider comprehensive coverage, which protects against non-collision incidents like theft, vandalism, or natural disasters. As vintage cars may be more susceptible to such risks, this coverage is an important component of your protection strategy.

Lastly, look into liability collision coverage, which covers damage to your vehicle in the event of an accident. Given the rarity and value of classic models, ensuring you have adequate collision coverage can prevent significant financial loss.

In summary, evaluating coverage options for vintage Japanese cars involves a careful assessment of various types of insurance. Choose protection that aligns with your vehicle’s value, usage, and your personal preferences to ensure your classic remains secure and well-covered.

Understanding the Claims Process for Classic Vehicles

When you’re insuring your classic Japanese car, it’s crucial to understand the claims process to ensure proper protection in case of damages or losses. The claims process can vary significantly from standard vehicle insurance, given the unique value and history associated with classic cars.

First and foremost, it’s important to select an insurance provider that specializes in classic vehicles. These companies often have tailored policies that address the specific needs of vintage cars, such as agreed value coverage. This means that in the event of a total loss, you will receive the full agreed value rather than just the depreciated market value.

Once you’ve secured your policy, familiarize yourself with the claims procedure outlined in your insurance contract. Generally, the process begins with documenting the damage or loss. Take clear photographs and gather evidence that accurately reflects the condition of your vehicle prior to the incident. This documentation is vital for substantiating your claim.

Next, promptly report the incident to your insurance provider through their designated channels. Many companies offer online claim submissions, which can expedite the process. Provide all necessary information, including your policy number, details of the incident, and any supporting documentation.

After your claim is submitted, an adjuster will be assigned to assess the damage. This step may involve an inspection of your vehicle, so be prepared to present any collected evidence. The adjuster will evaluate the circumstances and determine the validity of your claim based on the policy’s terms.

Following the assessment, you will receive a claim decision. If approved, you will be informed of the next steps for repairs or payment. Keep in mind that if your claim is denied, you have the right to appeal the decision. Understanding your policy and the claims process can greatly affect the outcome in the event of a mishap. Always maintain clear communication with your insurer throughout, ensuring you’re well-informed and adequately protected.

Tips for Reducing Premiums on Classic Car Insurance

When it comes to classic car insurance, finding ways to reduce premiums while ensuring adequate protection is crucial for enthusiasts. Here are some effective strategies that can help lower your insurance costs without compromising on coverage.

First, consider increasing your deductible. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can significantly reduce your premium. Assess your financial situation to determine a deductible that aligns with your budget.

Additionally, many insurance providers offer discounts for members of classic car clubs. Joining a recognized organization can not only provide a sense of community but also potentially lower your insurance rates. Always inquire about affiliation discounts when obtaining quotes.

Another way to lower your premiums is by securing your vehicle in a safe location. Storing your classic car in a locked garage instead of on the street can reduce the risk of theft or damage, which in turn often leads to lower rates. Make sure to communicate this information to your insurer.

Taking a driving course specifically for classic cars may also qualify you for discounts. Insurance companies often reward drivers who demonstrate enhanced skills and knowledge in operating unique vehicles, so look for certified programs in your area.

Finally, regularly review your policy and shop around for the best rates. Insurance needs can change over time, and comparing quotes from different providers can reveal better coverage options or lower premiums. Don’t hesitate to negotiate with your current insurer, as they may be willing to adjust your rates to retain your business.